#Measured Moves With Fibonacci Extensions

Explore tagged Tumblr posts

Text

5 Key Indicators Every Trader Should Know: Essential Tools for Today's Market

The Trading Compass: Navigating India's Current Market

Hey there, fellow traders! 📈 Have you been feeling the market's unpredictability lately? You're not alone! I've been trading through this volatility too, and wanted to share some hard-earned wisdom about the technical indicators that have truly made a difference in my decision-making process.

India's market has been particularly turbulent recently, with everything from global economic shifts to domestic policy changes throwing curveballs our way. That's why having reliable tools to guide your trading decisions isn't just helpful—it's essential for survival in today's market environment.

Let me walk you through the five indicators I personally rely on every single day:

1. RSI: Your Market Mood Reader

Think of the Relative Strength Index as your market psychiatrist—it tells you when the market is getting too emotional in either direction. On a scale of 0-100, it measures whether an asset is potentially overvalued or undervalued.

I've found RSI incredibly reliable lately, especially when:

It pushes above 70, suggesting a stock might be running too hot (happening frequently in our tech sector right now)

It dips below 30, hinting at oversold conditions (I've found some great bargains in manufacturing this way)

2. MACD: Your Trend's Best Friend

Don't let the complicated name fool you! The Moving Average Convergence Divergence indicator simply helps you understand the momentum and direction of trends.

Here's how I personally use MACD in today's market:

When the MACD line crosses above the signal line, I pay attention—this bullish signal has been remarkably accurate in renewable energy stocks lately (helped me catch a 12% move just last week!)

I watch the histogram to see momentum building or fading—crucial for timing entries and exits

Zero-line crossings give me confidence about the overall trend direction—essential for my medium-term positions

3. Bollinger Bands: Your Volatility Visualizer

In times like these, understanding volatility is everything—and Bollinger Bands make it visual. They expand during chaotic periods and contract during calmer ones.

Three ways I apply Bollinger Bands in my daily trading:

Band width immediately shows me if volatility is increasing/decreasing—absolutely crucial as our markets navigate current transitions (saved me from several false breakouts recently)

I love finding mean reversion opportunities when prices touch band extremes—this strategy has been particularly profitable in FMCG stocks

After consolidation periods, decisive band breakouts often precede strong trends—I've seen this pattern repeatedly in banking stocks this year

4. VWAP: Your Institutional Edge

As algorithms dominate more trading, understanding where big money is active becomes critical. VWAP (Volume-Weighted Average Price) helps me see the true average price incorporating volume—essentially showing where institutions are likely active.

Here's how VWAP gives me an edge:

Major institutions use it for execution benchmarks, creating natural support/resistance levels

Trading above/below VWAP helps confirm my intraday bias—essential in today's quick-moving markets

I use it as an exit benchmark to improve my average performance

5. Fibonacci Retracement: Your Timeless Market Map

It amazes me that a mathematical sequence discovered centuries ago works so well in our digital markets today, but Fibonacci retracement levels consistently help identify potential turning points.

My three favorite Fibonacci applications:

The 38.2%, 50%, and 61.8% retracement levels provide amazing entry points in trends—I've used these successfully throughout this year's commodity cycles

Fibonacci extensions help me project realistic profit targets beyond previous highs/lows

When Fibonacci levels align with other indicators like RSI or MACD, the high-probability setups that emerge have dramatically improved my win rate

Bringing It All Together: The Integrated Approach

Here's what I've learned after years of trading: while each indicator offers valuable insights, the real magic happens when you combine them strategically. I don't make major trading decisions without confirmation from multiple indicators—it's like having several expert advisors all agreeing on the same trade. You can learn this strategies and how to effectively apply them by enrolling in the Stock Market Courses in Mumbai

I'd love to hear which indicators you find most helpful in your trading! Drop a comment below and let's learn from each other. Happy trading! 📊

1 note

·

View note

Text

FxPro South Africa

What are the ways to set targets in Forex trading?

Forex trading involves several complications, and a trader should evaluate them carefully to control losses. However, one should consider setting targets in forex trading that will help ensure more advantages. Targets are crucial in currency trading because they provide ways to earn profits and manage risks. Setting targets enables a trader to eliminate emotions from trading and experience peace of mind. On the other hand, one should know how to set targets properly, which gives ways to overcome unwanted issues.

How to set targets in forex trading?

Using a risk-reward ratio

A risk-reward ratio lets a trader have predetermined stop-loss and profit targets that help to make informed decisions. Moreover, it shows ways to implement a consistent trading strategy that aligns with the trading goals. A high risk-reward ratio may lower the winning rates, and new traders should select a small target to have a high winning rate.

Support and resistance levels

A support and resistance level allows traders to set targets in forex trading, which ultimately gives ways to achieve the best results. The support level enables traders to know the price when an asset becomes undervalued. Similarly, a resistance level will help determine the price of an overvalued asset. Traders should consider using the auto-support and resistance indicators to take a profit based on the results.

Pattern projections

Forex trading uses several chart patterns, and they have predesignated take-profit targets in trading. Some traders utilize the pattern height to determine the price movements after a successful breakout. FxPro South Africa is an ideal platform for those who want to identify trends with different charts. It provides ways to measure projections based on chart patterns to proceed further in currency trading.

Partial trade closing

Partial trade closing is another technique that allows traders to take some profit from trading and continue to ride the trend in a certain direction. On the other hand, one should use any of the above strategies for taking a profit percentage when a price hits a profit target.

Trailing stop-loss

This technique works similar to partial trade closing, and a trader should set a trailing stop-loss after the price hits the first target. One can even use other tools, such as moving averages for stop-loss trailing.

Fibonacci extensions

Fibonacci extensions let Forex traders use calculations based on the Fibonacci sequence, which help determine potential profit target levels. They show ways to set targets at each extension to take some profits.

1 note

·

View note

Text

🚀 Complete Guide to Runaway Gap: Decode This Momentum Signal Like a Pro

The stock market speaks in signals. Among them, few are as visually loud and behaviorally bold as a runaway gap. For traders chasing strong trends, understanding this gap is not optional—it’s essential. Let’s dive into what makes the runaway gap a favorite among momentum traders, especially in markets like India’s NSE and BSE.

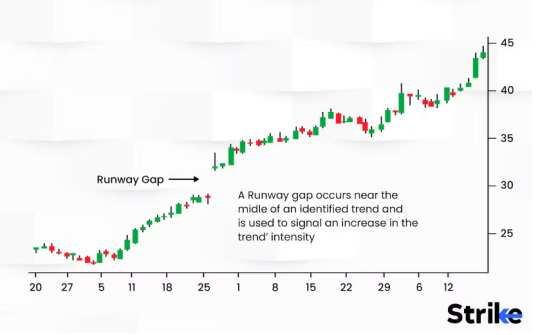

📈 What Is a Runaway Gap & Why Does It Matter to Traders?

A runaway gap, also known as a measuring gap or continuation gap, is a price jump that occurs mid-trend—not at the beginning, not at the end, but when the market is already in full swing. It typically reflects increased investor interest, a sudden surge in demand or supply, and signals that the current trend is far from over.

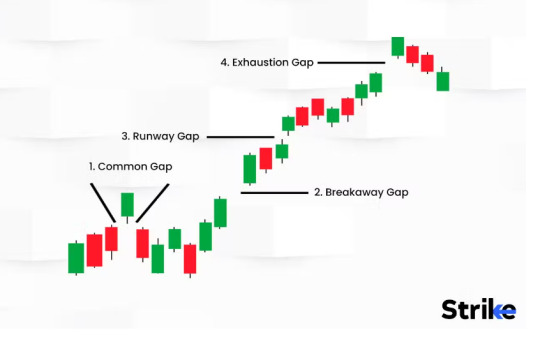

💡 It’s different from:

Breakaway gaps that launch new trends.

Exhaustion gaps that signal trend reversal.

A runaway gap doesn’t just suggest strength—it confirms it.

🧠 How to Identify a Runaway Gap on Charts (Without Guessing)

Look for these signs: ✨ A clear gap on the price chart in the direction of the prevailing trend ✨ No overlapping candles from the previous session ✨ Spiking volume during the gap ✨ No immediate reversal after the gap

✅ Tip: Use tools like Strike Money or TradingView to visualize these gaps accurately with candlestick patterns and volume indicators.

🪙 Example: Runaway Gap in TATA Motors (NSE)

In October 2023, TATA Motors saw a surge from ₹610 to ₹645 overnight after reporting stellar earnings and an upgrade from global brokerages. There was no prior resistance at ₹645, and the volume hit a 52-week high.

👉 This wasn’t a breakaway—it happened in the middle of a 3-month uptrend. 👉 The trend continued for 4 more weeks, touching ₹720. ✅ Classic runaway gap.

🔍 Breakaway vs Runaway vs Exhaustion Gap: Why It Matters

🟥 Breakaway Gap ➤ Appears at the start of a trend 🟨 Runaway Gap ➤ Occurs mid-trend, confirms momentum 🟩 Exhaustion Gap ➤ Near the end, often reversed shortly after

🎯 Misidentifying a gap type can lead to wrong entries or mistimed exits.

🔬 What Research Says About Runaway Gaps (Backed by Data)

According to the Journal of Technical Analysis (2021), runaway gaps have a 68% continuation rate over the next 10 trading days. 📊 A Bloomberg Intelligence report showed that Nifty 50 stocks forming runaway gaps in high-volume environments had a 20% higher probability of achieving new short-term highs.

📚 As John J. Murphy notes in Technical Analysis of the Financial Markets, “Runaway gaps typically occur halfway through a move and act as a measuring tool for future price projection.”

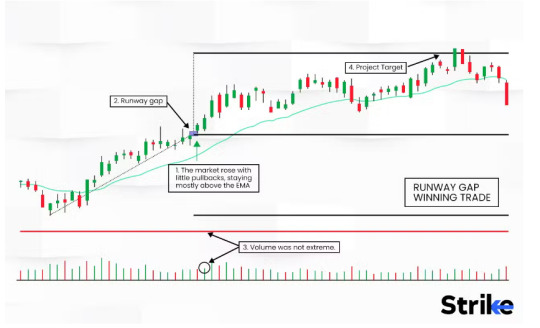

🔄 Why Volume Confirms the Runaway Gap (Don’t Ignore This)

🔊 Volume is the amplifier of a gap’s credibility. A runaway gap without volume is like a rocket without fuel—it might lift off, but it won’t last.

In the HDFC Bank case (June 2023), a ₹50 upward gap came with 2x average volume. Analysts called it speculative. Within 2 sessions, the price pulled back and filled the gap—proving it wasn’t a true runaway gap.

💡 Look for volume confirmation using Strike Money’s volume overlay feature. It helps distinguish valid moves from fakeouts.

💡 Market Psychology Behind Runaway Gaps

Runaway gaps tell a story: 🔹 Buyers or sellers are in control 🔹 News, earnings, or macro triggers fuel mass action 🔹 Late entrants jump in, pushing the trend further 🔹 Short-sellers get squeezed, adding more pressure

🧠 It’s not just technical—it’s psychological warfare on charts.

📊 How to Trade a Runaway Gap: Entry, Stop Loss, and Target

🔥 Entry: Wait for the first pullback candle after the gap. Enter on next green (bullish trend) or red (bearish trend) candle. 🛑 Stop Loss: Set it just below the gap low (bullish) or above the gap high (bearish). 🎯 Target: Use Fibonacci extensions or project the same move as before the gap—it often mirrors.

✅ Strike Money’s tools make this analysis visual and beginner-friendly.

📌 Real-World Runaway Gap Example: INFOSYS in January 2024

INFY jumped from ₹1,480 to ₹1,545 after beating Q3 earnings. 📈 Volume was 2.3x the daily average 📈 RSI showed bullish divergence 📈 Analysts on Moneycontrol projected a ₹1,600 target 📈 Price hit ₹1,610 in the next 8 sessions ✅ Clean runaway gap confirmed with trend continuation

❌ Common Mistakes When Trading Runaway Gaps

⚠️ Jumping in without volume confirmation ⚠️ Mistaking an exhaustion gap for a continuation ⚠️ Ignoring macro triggers like RBI policies or global cues ⚠️ Placing stops too tight, getting stopped out early

🧠 Remember: Gaps aren’t guarantees. They're signals. Combine with confirmation tools like Strike Money.

🛠️ Best Tools to Spot Runaway Gaps in Indian Market

📍 Strike Money – Made for Indian traders. Visualize gaps, draw zones, use real-time volume overlays. 📍 TradingView India – Deep historical charts, useful for backtesting. 📍 Finviz – For U.S. markets, but not ideal for NSE/BSE. 📍 ThinkorSwim (TOS) – Professional-level, more common with F&O traders.

💬 “Strike Money has a visual gap detection module that helps me never miss a runaway,” says Mumbai-based trader Ankit Mehra.

📚 What Experts Say About Runaway Gaps

🧠 John J. Murphy: “Runaway gaps provide a psychological midpoint—where the crowd acknowledges the trend and joins it.” 📊 Nithin Kamath (Zerodha) has noted in interviews that gap-based strategies work well in news-driven moves, particularly in the mid-cap space. 💬 Investopedia defines it as “a strong signal that institutional money is flowing in and continuing a trend.”

💬 FAQs About Runaway Gaps (Clear the Confusion)

🔹 Do runaway gaps always fill? Not always. Only 30–35% fill within 30 days if confirmed with volume.

🔹 Are they bullish or bearish? They can be both. It depends on the trend direction.

🔹 Best timeframe to trade them? Daily charts work best. But intraday traders use 15-min charts with volume.

🔹 How to confirm one? Volume spike, strong trend context, and no overlap with prior candles.

🔹 What if it fails? Use tight stop loss. Not every gap is tradeable.

🎯 Final Thoughts: Make Runaway Gaps Work for You

📌 Runaway gaps are powerful technical tools—but only when used right. 📌 They appear mid-trend and can forecast strong continuation moves. 📌 Confirm with volume, momentum, and context. 📌 Use charting tools like Strike Money to visualize and act confidently. 📌 Learn from past Indian stock cases—TATA Motors, INFOSYS, HDFC Bank—and apply insights in real time.

🔑 In trading, timing is everything. Recognizing a runaway gap might just be the edge you need.

0 notes

Text

The A.I. and Stock Market Tops Are In Final Blow Off Stage

The Fibonacci extension on the SP500 chart shows that it has reached the 618 halfway move and then blasted past the 100% measured move. So what will happen next? When hot terms like A.I. are used to advertise, say, toothbrushes, have we finally hit the peak? Is this a sign of exhaustion, or are we just getting started?

Watch Chris’ Video Analysis Here

#stocks#money#investing#nasdaq#daytrading#precious metals#commodities#sp500#ai#technology stocks#technology

1 note

·

View note

Text

Identifying the Cup and Handle Pattern on Price Charts

The cup and handle pattern is a popular technical analysis pattern used by traders to identify potential bullish continuation patterns in price charts. It consists of two main components: the cup, which resembles a rounded bottom, and the handle, which forms a smaller consolidation pattern near the highs of the cup. Here's how to identify the cup and handle pattern on price charts:

1. Formation of the Cup:

The cup portion of the pattern typically begins with a downtrend, as prices decline.

As the downtrend exhausts, prices gradually start to reverse and form a rounded bottom, resembling a "cup" shape.

The cup should exhibit smooth and rounded price action, indicating a gradual transition from selling pressure to buying pressure.

The depth and duration of the cup can vary, but it should generally span several weeks to months.

2. Formation of the Handle:

After the cup formation, prices may experience a minor pullback or consolidation phase, forming the handle of the pattern.

The handle is characterized by lower trading volume and narrower price swings compared to the cup.

It typically takes the shape of a smaller, downward-sloping price channel or a sideways consolidation pattern.

The duration of the handle is usually shorter than that of the cup, typically spanning several days to a few weeks.

3. Breakout Confirmation:

The cup and handle pattern is considered complete when prices break out above the resistance level formed by the highs of the cup.

This breakout is accompanied by increased trading volume, indicating renewed buying interest and potential continuation of the uptrend.

Traders often look for a decisive breakout with a strong close above the resistance level to confirm the pattern's validity.

4. Volume Analysis:

Volume analysis plays a crucial role in confirming the cup and handle pattern.

During the formation of the cup, trading volume tends to decline as prices stabilize and begin to reverse.

In the handle formation, volume should contract further, signaling reduced selling pressure and potential accumulation by buyers.

A breakout accompanied by above-average volume adds credibility to the pattern and increases the likelihood of a sustained uptrend.

5. Price Targets:

Traders often use the height of the cup as a price target for the breakout move.

To calculate the price target, measure the distance from the lowest point of the cup to the highest point and add it to the breakout level.

Additionally, some traders use Fibonacci extensions or other technical analysis tools to identify potential price targets beyond the initial target.

Conclusion:

Identifying the cup and handle pattern on price charts requires careful observation of price action, volume trends, and pattern characteristics. While the pattern can signal bullish continuation, traders should always use additional confirmation signals and risk management techniques before making trading decisions based on technical patterns alone.

0 notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the January options expiration in the books, equity markets showed strength with both the large cap S&P 500 and Nasdaq 100 closing at new all-time highs. Elsewhere looked for Gold ($GLD) to continue its pullback in the uptrend while Crude Oil ($USO) consolidated in a narrow range. The US Dollar Index ($DXY) continued to bounce to the upside while US Treasuries ($TLT) remained in their downtrend. The Shanghai Composite ($ASHR) looked to continue its trend lower while Emerging Markets ($EEM) consolidated over long term support.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. The charts of the $SPY and $QQQ looked strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY had reset momentum measures and both were very strong. The $IWM remained the exception bouncing around in a range that has held it for almost 2 years.

The week played out with Gold continuing lower, but slowing the pace, while Crude Oil broke the consolidation range to the upside. The US Dollar held in a tight range while Treasuries slowed their pace on the move lower as well. The Shanghai Composite soared following a Government stimulus package while Emerging Markets held in a tight range in consolidation. Volatility held on the lower edge of the teens, ending little changed.

This continued the tailwind for equities and they started the week moving higher. The IWM settled into a range after Monday, while the QQQ stalled after Wednesday with the SPY continuing higher all week. This resulted in the SPY ending at an all-time highs with the QQQ just off its Wednesday high print. The IWM remained in the 18 month consolidation. What does this mean for the coming week? Let’s look at some charts.

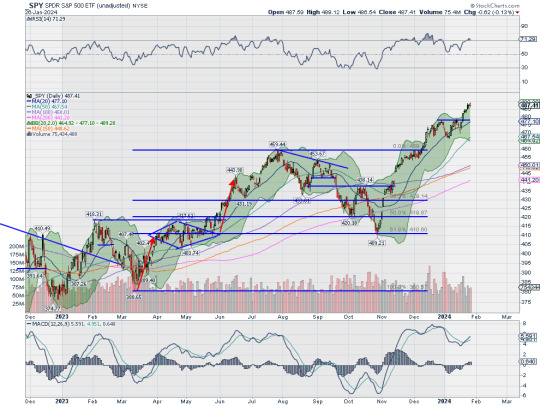

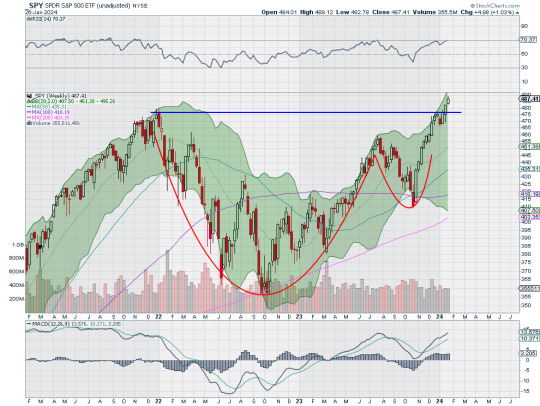

SPY Daily, $SPY

The SPY came into the week at an all-time high. It continued to move higher all week, printing new highs Monday through Thursday, before profit taking Friday afternoon saw the streak end. The daily chart shows the march higher along the open Bollinger Bands® after breaking short term resistance. The RSI is edging into overbought territory in the bullish zone with the MACD crossed back up, rising and positive.

The weekly chart has now printed a Three Advancing White Soldiers pattern showing continuation. There is the 161.8% Fibonacci extension of the retracement of the 2023 pullback nearby at 490.50 and 200% extension at 509.67. It also has a target on a Cup and Handle pattern to 560. The RSI on this timeframe is strong in the bullish zone with the MACD positive and rising. There is no resistance above 488. Support lower comes at 478 and 473.50 then 470 and 466 before 463.50 and 460. Uptrend.

SPY Weekly, $SPY

With just 3 trading days left in January, equity markets look ready to finish the month higher. Elsewhere look for Gold to continue its pullback while Crude Oil reverses higher. The US Dollar Index looks to drift sideways in consolidation while US Treasuries continue their downtrend. The Shanghai Composite looks to extend the bounce to the upside while Emerging Markets continue in consolidation.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY could end up rolling over to reset momentum measures as both are extended. If that happens it might be time for the IWM to finally take the lead and test the 20 month channel consolidation. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview January 26, 2024

0 notes

Text

Solana has a bullish structure on the four-hour chart but a bearish one on the daily timeframe The lower timeframe sentiment showed bullish conviction had dried up Solana [SOL] bulls saw their fortunes change over the past few days when the selling pressure eased and gave them a moment’s respite. The past week saw a bounce in prices that measured close to 20%. Read Solana’s [SOL] Price Prediction 2023-24 A recent report highlighted the impact commentary and interactions on social media can have on the price of crypto assets. While SOL has some near-term bullish strength, the market sentiment was not firmly bullish at press time. Can Solana break the bearish market structure? Source: SOL/USDT on TradingView The rally from $12.8 to $32.13 in June and July was used to plot a set of Fibonacci retracement levels (pale yellow). The 78.6% extension level was at $16.94. In the past ten days, the lowest SOL reached was $17.33 before buying pressure took the prices higher. Hence, the support level did not face a test, and the price could be attracted to it since it was also a short-term resistance back in mid-June. It presented an attractive liquidity pocket. The daily market structure remained bearish as SOL needed to beat the $20.6 level to flip it bullishly. The Relative Strength Index (RSI) was just above neutral 50 and signaled a possible shift in the trend was at hand. The On-Balance Volume (OBV) also broke above September’s resistance and indicated buyer strength was growing. A move past $20.6 and retest could offer a buying opportunity targeting $25.4 and $27.5. The Open Interest chart showed disinterested bulls Source: Coinalyze The Open Interest has been in decline over the past 24 hours and the spot Cumulative Volume Delta (CVD) has also plunged lower. During this time Solana traded at the $20 level, and faces resistance up to the $20.6 mark. The funding rate was negative to highlight short positions had the majority. How much are 1, 10, or 100 SOL worth today? The falling OI beneath a resistance zone showed speculators lacked bullish conviction. The falling spot CVD was evidence of strong selling pressure. Hence, the short-term sentiment appeared bearish and SOL could experience a minor pullback from $20 before bouncing higher. Source

0 notes

Text

Measured Moves With Fibonacci Extensions

Watch video on YouTube here: Measured Moves With Fibonacci Extensions Measured Moves With Fibonacci Extensions For more information and a free trial, visit https://stockchart.pro In this video we take a look at how we use Fibonacci Extensions to project a price target. Our stock and options trades performance record is unprecedented in the industry. 1000 trades have gained 90% or more since the inception of the service. Learn Technical Analysis For Trading Profits https://youtu.be/x60BlFuplyw You can earn while you learn how to trade. We teach you a simple approach to stock trading which will realize amazing profits. Daily trade signals, weekly video updates, and special blog posts will keep you connected to the market. In order to learn technical analysis of stock charts, you don' t have to understand a lot of indicators and strategies. 3 simple rules and risk management is all you need. For more videos visit Technical Analysis of Stock Trends: https://www.youtube.com/playlist?list=PLC5c8vqpxk16zWgiMogQN2xQIm6eLuPk9 If you are tired of too many indicators, complicated trading strategies, missing trends and losing money, let us show you the simple way to trading success. Remember, the definition of insanity is repeating your trading and investing mistakes over and over again and NOT doing anything about it, so sign up for our 10 day free trial today and see the results for yourself! Join us on: Facebook: https://ift.tt/2FbRYi5 Twitter: https://twitter.com/StockChartPro1 Instagram: https://ift.tt/2HFUYHd For more videos visit Technical Analysis of Stock Trends: https://www.youtube.com/playlist?list=PLC5c8vqpxk16zWgiMogQN2xQIm6eLuPk9 #stockchart #stockpredictions #Fibonacciextensions #technicalanalysis by Stock Chart Pro

0 notes

Text

Dogecoin, VeChain & Axie Infinity — Asian Wrap 15 July

Dogecoin Price Prediction: DOGE bulls comeback could trigger 38% rally

Dogecoin price has been on a steady and tiring downtrend since May 8. After a brief dip below the range low, DOGE has reclaimed it, indicating that the buyers might have come to the rescue.

Although undecided for now, an uptrend could stem here if the bullish momentum continues to accrue.

Dogecoin price has shed roughly 73% from its all-time high at $0.745 on May 8, portraying the depth of the current sell-off. While DOGE did slide below the range low at $0.194, it has recovered relatively quickly, suggesting that the buyers have come to the rescue.

VeChain price to follow historical precedent, as VET braces for a 27% decline

VeChain price triggered a head-and-shoulders topping pattern yesterday, confirming the fragility of the price structure plotted since the June 22 low. The mild VET rebound today does not disrupt the bearish outlook, and all the evidence continues to point to at least a break of the June 22 low of $0.059.

VeChain price, from May 23 until June 19, framed a head-and-shoulders pattern that began with a rising wedge pattern. The result of the topping pattern was a VET drop of nearly -40% over three days, including a -25.57% selloff on June 21. The magnitude of the decline matched the head-and-shoulders pattern’s measured move of -39.72%.

AXS Price Prediction: Axie Infinity may be on the brink of a 30% decline

AXS price has displayed incredible relative strength since the June 22 low, outpacing all of the cryptocurrencies on the watchlist by a sizable margin. The resulting overbought condition and elevation to an important Fibonacci extension level introduce some doubt about the rally’s sustainability from the current price. It is time to contemplate a minor correction for Axie Infinity to release the price compression in the coming days.

source https://usapangbitcoin.org/dogecoin-vechain-axie-infinity-asian-wrap-15-july/

source https://usapangbitcoin.wordpress.com/2021/11/29/dogecoin-vechain-axie-infinity-asian-wrap-15-july/

0 notes

Text

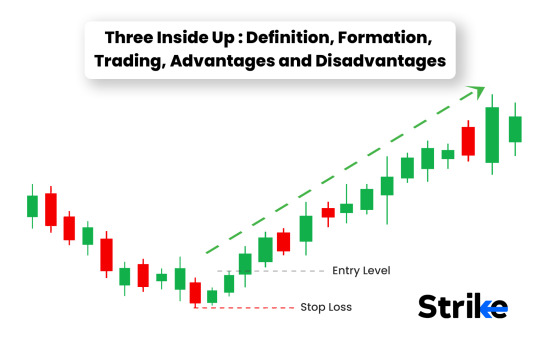

✅ Complete Guide to the Three Inside Up Candlestick Pattern (with Indian Market Examples)

In a volatile market, spotting the early signs of a bullish reversal can be the difference between getting in early or missing the move. The Three Inside Up candlestick pattern is one such tool that traders across the globe, including in Indian stock markets, use to anticipate a reversal in a downtrend.

Let’s break it down into actionable insights—no fluff, just straight-up strategy.

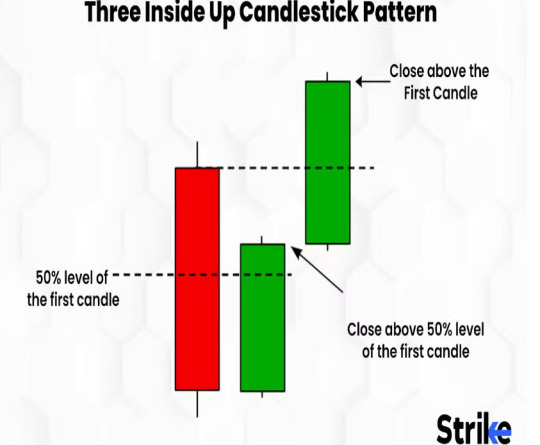

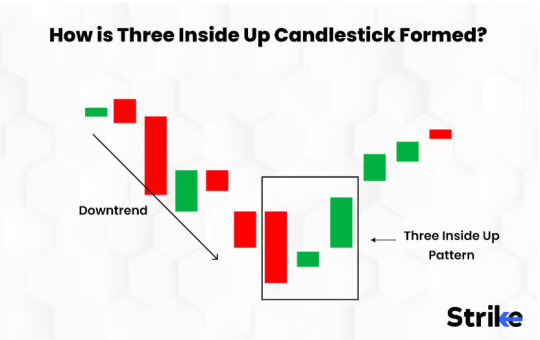

🔍 What Exactly is the Three Inside Up Pattern?

The Three Inside Up is a three-candle bullish reversal pattern found on candlestick charts. It usually appears after a downtrend and signals that the selling pressure might be fading.

Here's what it looks like:

First candle: A large red (bearish) candle

Second candle: A smaller green (bullish) candle that closes within the first candle’s body

Third candle: Another bullish candle that closes above the high of the first candle

This formation reflects a gradual shift in market sentiment from bearish to bullish.

🧠 Why Does the Three Inside Up Pattern Actually Work?

It's not magic—it's market psychology.

The first candle shows strong selling.

The second candle reveals buying interest creeping in.

The third candle confirms that bulls are taking over.

This gradual shift is often more reliable than single-candle reversals because it reflects a confirmation over multiple sessions.

📉 Where You’ll Find It in the Indian Markets

Let’s talk real.

In October 2023, Tata Motors showed a textbook Three Inside Up pattern on the daily chart using Strike Money, a powerful charting tool for Indian equities. This appeared after a week-long downtrend. The third candle closed above the high of the first bearish candle, and over the next 7 sessions, the stock rallied by over 12%.

Other Indian stocks that have shown this pattern effectively:

Infosys (NSE: INFY) – Feb 2023 on the daily chart

HDFC Bank (NSE: HDFCBANK) – March 2024, post-Q3 earnings dip

ICICI Bank (NSE: ICICIBANK) – August 2023, during a sector rotation phase

🧩 The Anatomy of the Pattern – And Why It Matters

To spot a valid Three Inside Up, make sure:

The second candle opens and closes within the first candle

The third candle closes above the first candle's high

The pattern forms after a recognizable downtrend

Many new traders miss this: Context is everything. The pattern is only powerful when it follows a downtrend. Without the trend, it’s just noise.

📊 Is the Three Inside Up Pattern Actually Reliable? Here’s What Research Shows

Let’s bring in data.

According to Thomas Bulkowski, a respected name in pattern analytics:

The Three Inside Up pattern has a 66% success rate in bullish reversals (tested across 10,000+ samples).

When confirmed with volume analysis and RSI divergence, the success rate climbs over 70%.

In the Indian market, backtesting on NIFTY 50 stocks (2019–2024) using Strike Money’s backtest engine shows:

An average 5-day gain of 3.4% post-pattern

Best performance on daily and weekly timeframes

Higher accuracy during low-volatility environments

⚙️ How to Trade the Three Inside Up Pattern: A Simple Strategy

Ready to take action?

Here’s how pro traders use it:

🟢 Entry:

On the fourth candle, if the price breaks the high of the third candle

🔴 Stop Loss:

Just below the low of the second candle

🟡 Profit Targets:

Use Fibonacci extensions, previous resistance zones, or risk-reward ratios (1:2 is solid)

📈 Confirmations that Add Confidence:

Rising RSI or crossover from oversold

MACD bullish crossover

Volume spike on the third candle

Positive divergence in OBV or CMF

Tools like Strike Money allow you to set alerts for when this pattern occurs, so you don’t miss real-time opportunities.

🧠 Here’s Why It’s Safer Than Some Flashy Patterns

Not every bullish pattern is equal.

Unlike a Bullish Engulfing (which is aggressive) or Hammer (which relies on a single candle), the Three Inside Up is more measured. It reflects a transitional psychology—not a sudden flip.

This makes it ideal for:

Swing traders

Positional traders

Options buyers who need directional confidence

🆚 Three Inside Up vs. Morning Star vs. Engulfing – What’s the Real Difference?

They all sound bullish, but here's what sets them apart:

Morning Star: Has a gap down and a doji, more dramatic reversal

Bullish Engulfing: Stronger but riskier—needs no confirmation

Three Inside Up: Balanced, gradual, more reliable confirmation

If you like measured setups, Three Inside Up > Bullish Engulfing.

📉 Don’t Make These Rookie Mistakes

Even strong patterns can fail if misused. Avoid these:

Trading it in a sideways market

Ignoring volume or RSI

Using it without support/resistance context

Entering before confirmation candle closes

Bonus tip: If you see this pattern form right at a 50-day EMA or demand zone, it’s golden.

📍 Real Charts, Real Results – Seen on Strike Money

Strike Money, a leading charting tool for Indian traders, offers smart detection for candlestick patterns. Here’s what you’ll love:

Built-in Three Inside Up scanner

Backtest feature to check how it performed on any stock

Custom alerts for pattern completion

Integration with Nifty, Bank Nifty, and Futures charts

For example:

HUL (NSE: HINDUNILVR) – Strike Money flagged a Three Inside Up in July 2023 on the 4-hour chart. The stock jumped 6.2% in three sessions.

🧠 Want to Level Up? Use These Tools to Spot the Pattern Automatically

Forget squinting at charts all day.

These tools make it seamless:

Strike Money (for Indian equities)

TradingView (for global markets, with community scripts)

Set alerts for:

“Three Inside Up detected”

RSI > 50

Price near 200 EMA

This kind of automation + confirmation = confidence.

🎯 Final Thoughts: When Should You Actually Trust the Three Inside Up?

Only trust it when:

It forms after a clear downtrend

You get confirmation by volume or indicators

The third candle closes strong, not weak or with a wick

It's aligned with support zones or key EMAs

Don’t treat it as a holy grail—it’s a tool, not a prediction engine. Combine it with your own style and risk management.

❓FAQs: Got Questions About the Three Inside Up Pattern?

Q: Can I use this pattern in intraday trading? Yes, but it's more reliable on daily or higher timeframes. If using for intraday, focus on 15-min or 30-min charts with confirmation.

Q: Does this work in Forex or Crypto? Absolutely. It’s been effective on BTC/USDT, EUR/USD, and ETH/USD pairs. Just make sure you adapt the stop-loss and take-profit levels.

Q: How often does the pattern fail? Like any pattern, it can fail. On average, failure occurs 34% of the time. Filtering it with volume and RSI improves accuracy.

Q: Is Strike Money free to use? It offers a free version, but pattern recognition and backtesting are part of the Pro plan.

🚀 Wrapping Up

The Three Inside Up is an excellent way to spot early bullish reversals—especially when backed by volume, trend analysis, and support zones. Whether you're trading NIFTY stocks, midcaps, or cryptos, this pattern gives you an edge.

Use tools like Strike Money to scan, confirm, and backtest your setups. And remember: The best traders don’t just find patterns—they understand when not to use them.

0 notes

Text

Gold Price Rally Hits Forecast Target

Gold Price Rally Hits Forecast Target

Gold Price Talking Points:

Gold prices moved up to another fresh 2019 high today, hitting a key Fibonacci extension in the process. In turn, more consolidation may be due ahead of the July Fed meeting.

The whipsaw in gold volatility, as measured by the Cboe’s ETF, GVZ (which tracks the 1-month implied volatility of gold as derived from the GLD ETF option chain) can be directly tied to the

View On WordPress

0 notes

Text

TRON price predictions 2019: The cryptocurrency is increasing in value consistently – USD / TRON price analysis (TRX / TRON Price Today) Tron Coin News -Tron Price Prediction

TRON price predictions 2019: The cryptocurrency is increasing in value consistently – USD / TRON price analysis (TRX / TRON Price Today) Tron Coin News -Tron Price Prediction

Tron’s price is steadily making its way up, and the Fib extension tool shows the next upside targets. So far, all the tech indicators are hinting at the idea that more gains are on their way to Tron.

Technical indicator signals

The 100 SMA went above the longer-term 200 SMA in order to confirm that the path of least resistance is to the upside. Long story short, it’s more likely to climb rather than to fall. Tron’s price formed and confirmed an inverse pattern to signal that there’s an uptrend on its way.

The appliance of the Fibonacci extension tool unveils the nest upside targets. Tron’s price managed to already surpass the 38.2% extension, and it’s closing in on the 50% extension. Stronger selling pressure could take the crypto up to the 61.8% extension or the 78.6% extension.

RSI is also moving up showing that there’s still some purchase pressure left. This could be quite enough to keep the bulls under control until Tron’s price reaches the next potential resistance levels just before buyers book the profit. Stochastic is also moving up, and this means that Tron’s price could do the same.

The market’s current state following Bithumb’s hacking

Lately, the main cryptos in the market seem to be finally doing better after the bearish trend that took control over the market recently. The coins managed to get over the Bithumb hack news better than everyone expected especially if we compare this unfortunate event with the hacking of the smaller South Korean exchange that took place on June 10. Some voices in the crypto space claim that this happened due to reports saying that Tether was used to manipulate Bitcoin’s price back in 2017. This lead to the belief that the probe by US regulators could trigger the same results.

Overall, Tron’s price seems to have been corrected, and an upward journey is currently expected for Justin Sun’s crypto.

TRON price predictions 2019: TRON is a platform which allows you to build and store the applications. It also allows you to execute the smart contracts based on its blockchain. Moreover, it makes it easier for you to freely publish the content as well as data. This ensures that for the entertainment industry as well as media industry, it is actually a pretty valuable blockchain. This also means that the applications of this particular blockchain are plenty.

With that being said, it is important to look into the cryptocurrency an investment asset as well. Many of the investors are trying to find out whether it is at investing levels currently or not.

The blockchain project, as well as its native currency TRX, has amassed a lot of attention over the past months. Tron provides a platform for developers to create and deploy decentralized applications (Dapps). Ever since Tron launched its Mainnet, it has been a treat to Ethereum. Recently, the founder and CEO of Tron – Justin Sun – said that the network now supports over fifty decentralized apps. Sun made this announcement on Twitter on Thursday, and he said the network is aimed at reaching 80 Dapps in the near term.

Tron Blockchain Achieved 100 Million Transactions in 173 Days

Justin Sun released this statement after the blockchain achieved a major milestone earlier this month. The network achieved 100M transactions over a period of 173 days. This means that an average of 578,034 transactions are being carried on the blockchain of Tron every day.

Tron Sees More Dapp Usage

Back in August, Martin Koppelmann said that a crucial statistic to use in measuring the growth rate of a smart contract protocol is the number of decentralized apps that interact with one another and the usage of decentralized apps. Koppelmann is the founder of Gnosis.ph – a prediction market platform based on the blockchain of Ethereum. According to Koppelmann: “The usage of Dapps is the number we care about. The next thing is to look out for the number of decentralized apps that interact with each other and benefit from each other for being on the same platform. As a side effect, the value of Ethereum (ETH) will then be a function of the demand for the use of apps in this open, reliable, and interrelated environment.” Tron is a smart contract protocol just like Ethereum, and the value of Tron comes from the ecosystem of its decentralized apps and active users.

Tron Dapp Usage Exceeds that of Ethereum

The top three decentralized apps on the Tron network have 2,300 users on average. TRONbet records 2,500 active users and a transaction volume of two million on a daily basis, according to DappRadar. DappRadar is an online platform that provides data on the usage of decentralized apps on major blockchain networks. In comparison, the top three decentralized applications on blockchain of Ethereum has 700 users on average. The three biggest decentralized apps on the network are IDEX, Crypto Heroes, and ForkDelta. However, EOS accounts for the highest number of decentralized app users on its network. TRON (TRX) Price Today – TRX / USD

EOS is the world’s second most valuable smart contract protocol after Ethereum. The top three Dapps on the network have almost 5,000 users on average; this is more than the Dapp users of Ethereum and Tron combined. The top three Dapps on EOS are EOS Knights, PRA CandyBox, and EOSBet. The Dapp usage on the network of Tron has recently exceeded that of Ethereum in terms of daily active users and decentralized apps. Tron and EOS have been focusing more on scalability over the past couple of months. They are focusing more on scalability in their development with the aim of supporting as many decentralized apps as possible in the ecosystem. This is something Ethereum has been lacking, and that is why a lot of developers on the network are now moving to either the blockchain of EOS or Tron.

TRON price predictions 2019:

You can check the cryptocurrency’s current price in the chart at the end of the article. According to investingpr.com, within 5 years, it is expected to trade around over $1. This is the reason why it is a good investment option as well. The main reason why the cryptocurrency is slated to increase by such a significant amount is owing to the increased usage of the platform. As more and more developers start using the platform, it will result in the appreciation of the cryptocurrency as well. This is the reason why the cryptocurrency is slated to increase further. Source: investingpr.com

The decentralized platform will also ensure that it becomes easier for the developers to publish the content. It is one of the very few blockchains which enables easy publishing of the content without any restrictions. This will again provide enormous versatility when it comes to the applications of this platform. As the applications of this platform increase, the usability will increase further. As the usability increases, the prize of the token will increase further. This is the reason why the potential in the platform is enormous. Source: investingpr.com

Thus, if you’re looking to invest in TRON now might be the perfect option to do so as the cryptocurrency is increasing in value consistently. With such large headroom for return in the future, it is worth a look. Source: investingpr.com

TRON [TRX] despite the recent ETH vs TRX controversy expands with 2500 nodes in 31 countries

ambcrypto

The drama related to the recent launch of Tron’s Test Net is still not done. Within a week of the Test Net launch, it has expanded to 31 countries with 2500 nodes despite a bearish market. TRON’s first technical debut – Test net came along with completed nodes, basic network functions, transactions, and customizable modules. This has given fans, followers and skeptics alike a transparent view of Tron’s solid progress.

Jacob Guinto, a TRON enthusiast tweeted:

“Holy, KILLING IT JUSTIN KILLINGGGGG ITTTT! I have personally setup 3 nodes in Czechia – easy process, immediate projection on the map – this is for real guys

great work from Tron foundation and Justin Sun. I think you can setup a node on the moon now.”

There were also people seeking clarification like Kasei Arakaki who asked,

“This is not a doubt or FUD. Asking a genuine question… do we have evidence these nodes are functioning and authentic? I’d love to see some more tangible information regarding the test net and how it is currently running and performing. Maybe someone could provide links for me?”

Tron plans to shed its ERC20 identity and migrate from the Ethereum platform. Once, this goes live, Tron will no longer be an ERC20 token but will become a true token within its own ecosystem.

When TRON’s code first arrived on the scene, TRON was a vibrant, energetic, upstart of a company; a great reflection of its millennial founder.

Justin Sun, the founder said,

“Today, TRON is retaining its fearless energy but adds a much-needed groundedness with the debut of its technology.”

WHAT IS TRON?

CRYPTOCURRENCY’S BUDDING FOUNDER JUSTIN SUN WANTS TO CHANGE THE INTERNET

Source: Newsweek

As the cryptocurrency craze continues, with Bitcoin leading the way, a slew of smaller, cheaper projects are emerging that investors are getting excited about. One is Tron, a coin that its Chinese founder hopes will challenge the world’s major content providers, such as Facebook and YouTube.

According to its website, Tron (TRX) is a blockchain-based platform that seeks to decentralize the internet, or rather content-sharing on the internet, ensuring that artists, creatives, musicians, authoring can release their content without having to use a middle company, be it Amazon, YouTube, Apple, or Facebook.

The digital currency was created by 26-year-old Justin Sun, a self-proclaimed protegé of Alibaba chief executive and billionaire Jack Ma. He has amassed 350,000 Twitter followers, promoting the coin to both its loyal followers and investors, as well as to the wider cryptocurrency community. Forbes listed him in its 30 under 30 for Asia in 2015 and he previously worked for another fledgling cryptocurrency, Ripple (XRP).

The former University of Pennsylvania student is one of the most vocal crypto-founders on the platform, from hosting a one-hour livestream about the coin to announcing partnerships to announcements of a new San Francisco office to promoting a vote for the coin to be accepted by new digital exchanges. He has even engaged in a back-and-forth with the famous founder of Litecoin, one of the top four cryptocurrencies, Charlie Lee, on Twitter.

THE TRON FOUNDATION

The currency to be used on the platform is known as “Tronix.” According to Sun, the cryptocurrency is already set to have a user base of at least 10 million, with Sun announcing that the Tron network will be implemented for his own Chinese social networking app Peiwo.

The coin has so far struck partnerships with a series of major companies, including Chinese video hardware and software provider Baofeng (which Sun dubbed the “netflix of China”), oBike, the largest bike-sharing company in Singapore, which will release “oCoins” on the Tron platform, with riders accumulating coins the more they ride. It also boasts investors such as Wei Dai, the founder of bike sharing company ofo, and a team of developers from Alibaba and Microsoft.

Sun has floated that it has a partnership in the works with a space exploration company, and rumors abound online about a partnership with Alibaba, although these remain unfounded.

It is mostly bought with Bitcoin or Ethereum, the number one and two cryptocurrencies, on the Tokyo-based exchange Binance, and at the time of writing had a market cap of almost $6 billion, despite its low price. The coin began life in September, trading at just a tenth of a penny.

That country is a major market for digital coins, and the country has signaled that it will not ban cryptocurrencies, but more stringently regulate them to stop market manipulation and fraud.

Cryptocurrency critics and advocates of Tron are divided on the potential of the project. Hype, potential, fears and doubt all shape the market price of a cryptocurrency, as does the market supply, and Tron is no different.

Detractors of Tron say that the coin has a circulation of 65 billion coins, too much for it to have any significant monetary value. By contrast, Ripple has a circulation of 38 billion. They also say that Tron is just an idea that is yet to be implemented, so no one can truly tell if it will be a success.

Tron Whitepaper

They have also pointed to the project’s “whitepaper” as one that bears hallmarks of other projects. But Sun has used his social media presence to add a sheen of transparency to the coin, challenging the claims of copying other projects and dampening the “FUD” (fear, uncertainty and doubt) around this coin.

There are day-traders who are trying to make money from cryptocurrency, buying low and selling high, but there are others who believe in the technology they are buying into.

Tron is in the top 15 cryptocurrencies

Supporters of Tron on social media point to the plans of Sun, as well as his leadership of the coin, his Chinese connections and its position in the top 15 cryptocurrencies, as a sign of the potential that the coin and the Tron platform could have for the internet, be it for gaming, mobile apps or online marketplaces. For example, on January 22, Tron Puppies will be released by game.com, where users can use Tron coins to play the game, Sun tweeted.

Whether Tron can shake up the Internet as Sun hopes remains to be seen. But what this coin has, like many others, is ambition to challenge the financial system and change the online space as we know it.

So cryptocurrency observers will be keeping an eye on Sun and his bid to surpass the Bezos’ and the Zuckerberg’s of the world, and investors will hope that the project that shares its name with the futuristic movie takes them to the stars.

NOTE: Investing in cryptocurrencies carries risks and anyone investing in the market should be prepared for volatility, a lack of regulation and even the presence of frauds and scams. Anyone considering such an investment should research their investment and be prepared to lose said investment.

Related

Source link http://bit.ly/2GL4K9F

0 notes

Text

TRON price predictions 2019: The cryptocurrency is increasing in value consistently – USD / TRON price analysis (TRX / TRON Price Today) Tron Coin News -Tron Price Prediction

TRON price predictions 2019: The cryptocurrency is increasing in value consistently – USD / TRON price analysis (TRX / TRON Price Today) Tron Coin News -Tron Price Prediction

Tron’s price is steadily making its way up, and the Fib extension tool shows the next upside targets. So far, all the tech indicators are hinting at the idea that more gains are on their way to Tron.

Technical indicator signals

The 100 SMA went above the longer-term 200 SMA in order to confirm that the path of least resistance is to the upside. Long story short, it’s more likely to climb rather than to fall. Tron’s price formed and confirmed an inverse pattern to signal that there’s an uptrend on its way.

The appliance of the Fibonacci extension tool unveils the nest upside targets. Tron’s price managed to already surpass the 38.2% extension, and it’s closing in on the 50% extension. Stronger selling pressure could take the crypto up to the 61.8% extension or the 78.6% extension.

RSI is also moving up showing that there’s still some purchase pressure left. This could be quite enough to keep the bulls under control until Tron’s price reaches the next potential resistance levels just before buyers book the profit. Stochastic is also moving up, and this means that Tron’s price could do the same.

The market’s current state following Bithumb’s hacking

Lately, the main cryptos in the market seem to be finally doing better after the bearish trend that took control over the market recently. The coins managed to get over the Bithumb hack news better than everyone expected especially if we compare this unfortunate event with the hacking of the smaller South Korean exchange that took place on June 10. Some voices in the crypto space claim that this happened due to reports saying that Tether was used to manipulate Bitcoin’s price back in 2017. This lead to the belief that the probe by US regulators could trigger the same results.

Overall, Tron’s price seems to have been corrected, and an upward journey is currently expected for Justin Sun’s crypto.

TRON price predictions 2019: TRON is a platform which allows you to build and store the applications. It also allows you to execute the smart contracts based on its blockchain. Moreover, it makes it easier for you to freely publish the content as well as data. This ensures that for the entertainment industry as well as media industry, it is actually a pretty valuable blockchain. This also means that the applications of this particular blockchain are plenty.

With that being said, it is important to look into the cryptocurrency an investment asset as well. Many of the investors are trying to find out whether it is at investing levels currently or not.

The blockchain project, as well as its native currency TRX, has amassed a lot of attention over the past months. Tron provides a platform for developers to create and deploy decentralized applications (Dapps). Ever since Tron launched its Mainnet, it has been a treat to Ethereum. Recently, the founder and CEO of Tron – Justin Sun – said that the network now supports over fifty decentralized apps. Sun made this announcement on Twitter on Thursday, and he said the network is aimed at reaching 80 Dapps in the near term.

Tron Blockchain Achieved 100 Million Transactions in 173 Days

Justin Sun released this statement after the blockchain achieved a major milestone earlier this month. The network achieved 100M transactions over a period of 173 days. This means that an average of 578,034 transactions are being carried on the blockchain of Tron every day.

Tron Sees More Dapp Usage

Back in August, Martin Koppelmann said that a crucial statistic to use in measuring the growth rate of a smart contract protocol is the number of decentralized apps that interact with one another and the usage of decentralized apps. Koppelmann is the founder of Gnosis.ph – a prediction market platform based on the blockchain of Ethereum. According to Koppelmann: “The usage of Dapps is the number we care about. The next thing is to look out for the number of decentralized apps that interact with each other and benefit from each other for being on the same platform. As a side effect, the value of Ethereum (ETH) will then be a function of the demand for the use of apps in this open, reliable, and interrelated environment.” Tron is a smart contract protocol just like Ethereum, and the value of Tron comes from the ecosystem of its decentralized apps and active users.

Tron Dapp Usage Exceeds that of Ethereum

The top three decentralized apps on the Tron network have 2,300 users on average. TRONbet records 2,500 active users and a transaction volume of two million on a daily basis, according to DappRadar. DappRadar is an online platform that provides data on the usage of decentralized apps on major blockchain networks. In comparison, the top three decentralized applications on blockchain of Ethereum has 700 users on average. The three biggest decentralized apps on the network are IDEX, Crypto Heroes, and ForkDelta. However, EOS accounts for the highest number of decentralized app users on its network. TRON (TRX) Price Today – TRX / USD

EOS is the world’s second most valuable smart contract protocol after Ethereum. The top three Dapps on the network have almost 5,000 users on average; this is more than the Dapp users of Ethereum and Tron combined. The top three Dapps on EOS are EOS Knights, PRA CandyBox, and EOSBet. The Dapp usage on the network of Tron has recently exceeded that of Ethereum in terms of daily active users and decentralized apps. Tron and EOS have been focusing more on scalability over the past couple of months. They are focusing more on scalability in their development with the aim of supporting as many decentralized apps as possible in the ecosystem. This is something Ethereum has been lacking, and that is why a lot of developers on the network are now moving to either the blockchain of EOS or Tron.

TRON price predictions 2019:

You can check the cryptocurrency’s current price in the chart at the end of the article. According to investingpr.com, within 5 years, it is expected to trade around over $1. This is the reason why it is a good investment option as well. The main reason why the cryptocurrency is slated to increase by such a significant amount is owing to the increased usage of the platform. As more and more developers start using the platform, it will result in the appreciation of the cryptocurrency as well. This is the reason why the cryptocurrency is slated to increase further. Source: investingpr.com

The decentralized platform will also ensure that it becomes easier for the developers to publish the content. It is one of the very few blockchains which enables easy publishing of the content without any restrictions. This will again provide enormous versatility when it comes to the applications of this platform. As the applications of this platform increase, the usability will increase further. As the usability increases, the prize of the token will increase further. This is the reason why the potential in the platform is enormous. Source: investingpr.com

Thus, if you’re looking to invest in TRON now might be the perfect option to do so as the cryptocurrency is increasing in value consistently. With such large headroom for return in the future, it is worth a look. Source: investingpr.com

TRON [TRX] despite the recent ETH vs TRX controversy expands with 2500 nodes in 31 countries

ambcrypto

The drama related to the recent launch of Tron’s Test Net is still not done. Within a week of the Test Net launch, it has expanded to 31 countries with 2500 nodes despite a bearish market. TRON’s first technical debut – Test net came along with completed nodes, basic network functions, transactions, and customizable modules. This has given fans, followers and skeptics alike a transparent view of Tron’s solid progress.

Jacob Guinto, a TRON enthusiast tweeted:

“Holy, KILLING IT JUSTIN KILLINGGGGG ITTTT! I have personally setup 3 nodes in Czechia – easy process, immediate projection on the map – this is for real guys

great work from Tron foundation and Justin Sun. I think you can setup a node on the moon now.”

There were also people seeking clarification like Kasei Arakaki who asked,

“This is not a doubt or FUD. Asking a genuine question… do we have evidence these nodes are functioning and authentic? I’d love to see some more tangible information regarding the test net and how it is currently running and performing. Maybe someone could provide links for me?”

Tron plans to shed its ERC20 identity and migrate from the Ethereum platform. Once, this goes live, Tron will no longer be an ERC20 token but will become a true token within its own ecosystem.

When TRON’s code first arrived on the scene, TRON was a vibrant, energetic, upstart of a company; a great reflection of its millennial founder.

Justin Sun, the founder said,

“Today, TRON is retaining its fearless energy but adds a much-needed groundedness with the debut of its technology.”

WHAT IS TRON?

CRYPTOCURRENCY’S BUDDING FOUNDER JUSTIN SUN WANTS TO CHANGE THE INTERNET

Source: Newsweek

As the cryptocurrency craze continues, with Bitcoin leading the way, a slew of smaller, cheaper projects are emerging that investors are getting excited about. One is Tron, a coin that its Chinese founder hopes will challenge the world’s major content providers, such as Facebook and YouTube.

According to its website, Tron (TRX) is a blockchain-based platform that seeks to decentralize the internet, or rather content-sharing on the internet, ensuring that artists, creatives, musicians, authoring can release their content without having to use a middle company, be it Amazon, YouTube, Apple, or Facebook.

The digital currency was created by 26-year-old Justin Sun, a self-proclaimed protegé of Alibaba chief executive and billionaire Jack Ma. He has amassed 350,000 Twitter followers, promoting the coin to both its loyal followers and investors, as well as to the wider cryptocurrency community. Forbes listed him in its 30 under 30 for Asia in 2015 and he previously worked for another fledgling cryptocurrency, Ripple (XRP).

The former University of Pennsylvania student is one of the most vocal crypto-founders on the platform, from hosting a one-hour livestream about the coin to announcing partnerships to announcements of a new San Francisco office to promoting a vote for the coin to be accepted by new digital exchanges. He has even engaged in a back-and-forth with the famous founder of Litecoin, one of the top four cryptocurrencies, Charlie Lee, on Twitter.

THE TRON FOUNDATION

The currency to be used on the platform is known as “Tronix.” According to Sun, the cryptocurrency is already set to have a user base of at least 10 million, with Sun announcing that the Tron network will be implemented for his own Chinese social networking app Peiwo.

The coin has so far struck partnerships with a series of major companies, including Chinese video hardware and software provider Baofeng (which Sun dubbed the “netflix of China”), oBike, the largest bike-sharing company in Singapore, which will release “oCoins” on the Tron platform, with riders accumulating coins the more they ride. It also boasts investors such as Wei Dai, the founder of bike sharing company ofo, and a team of developers from Alibaba and Microsoft.

Sun has floated that it has a partnership in the works with a space exploration company, and rumors abound online about a partnership with Alibaba, although these remain unfounded.

It is mostly bought with Bitcoin or Ethereum, the number one and two cryptocurrencies, on the Tokyo-based exchange Binance, and at the time of writing had a market cap of almost $6 billion, despite its low price. The coin began life in September, trading at just a tenth of a penny.

That country is a major market for digital coins, and the country has signaled that it will not ban cryptocurrencies, but more stringently regulate them to stop market manipulation and fraud.

Cryptocurrency critics and advocates of Tron are divided on the potential of the project. Hype, potential, fears and doubt all shape the market price of a cryptocurrency, as does the market supply, and Tron is no different.

Detractors of Tron say that the coin has a circulation of 65 billion coins, too much for it to have any significant monetary value. By contrast, Ripple has a circulation of 38 billion. They also say that Tron is just an idea that is yet to be implemented, so no one can truly tell if it will be a success.

Tron Whitepaper

They have also pointed to the project’s “whitepaper” as one that bears hallmarks of other projects. But Sun has used his social media presence to add a sheen of transparency to the coin, challenging the claims of copying other projects and dampening the “FUD” (fear, uncertainty and doubt) around this coin.

There are day-traders who are trying to make money from cryptocurrency, buying low and selling high, but there are others who believe in the technology they are buying into.

Tron is in the top 15 cryptocurrencies

Supporters of Tron on social media point to the plans of Sun, as well as his leadership of the coin, his Chinese connections and its position in the top 15 cryptocurrencies, as a sign of the potential that the coin and the Tron platform could have for the internet, be it for gaming, mobile apps or online marketplaces. For example, on January 22, Tron Puppies will be released by game.com, where users can use Tron coins to play the game, Sun tweeted.

Whether Tron can shake up the Internet as Sun hopes remains to be seen. But what this coin has, like many others, is ambition to challenge the financial system and change the online space as we know it.

So cryptocurrency observers will be keeping an eye on Sun and his bid to surpass the Bezos’ and the Zuckerberg’s of the world, and investors will hope that the project that shares its name with the futuristic movie takes them to the stars.

NOTE: Investing in cryptocurrencies carries risks and anyone investing in the market should be prepared for volatility, a lack of regulation and even the presence of frauds and scams. Anyone considering such an investment should research their investment and be prepared to lose said investment.

Related

Source link http://bit.ly/2GL4K9F

0 notes

Text

TRON price predictions 2019: The cryptocurrency is increasing in value consistently – USD / TRON price analysis (TRX / TRON Price Today) Tron Coin News -Tron Price Prediction

TRON price predictions 2019: The cryptocurrency is increasing in value consistently – USD / TRON price analysis (TRX / TRON Price Today) Tron Coin News -Tron Price Prediction

Tron’s price is steadily making its way up, and the Fib extension tool shows the next upside targets. So far, all the tech indicators are hinting at the idea that more gains are on their way to Tron.

Technical indicator signals

The 100 SMA went above the longer-term 200 SMA in order to confirm that the path of least resistance is to the upside. Long story short, it’s more likely to climb rather than to fall. Tron’s price formed and confirmed an inverse pattern to signal that there’s an uptrend on its way.

The appliance of the Fibonacci extension tool unveils the nest upside targets. Tron’s price managed to already surpass the 38.2% extension, and it’s closing in on the 50% extension. Stronger selling pressure could take the crypto up to the 61.8% extension or the 78.6% extension.

RSI is also moving up showing that there’s still some purchase pressure left. This could be quite enough to keep the bulls under control until Tron’s price reaches the next potential resistance levels just before buyers book the profit. Stochastic is also moving up, and this means that Tron’s price could do the same.

The market’s current state following Bithumb’s hacking

Lately, the main cryptos in the market seem to be finally doing better after the bearish trend that took control over the market recently. The coins managed to get over the Bithumb hack news better than everyone expected especially if we compare this unfortunate event with the hacking of the smaller South Korean exchange that took place on June 10. Some voices in the crypto space claim that this happened due to reports saying that Tether was used to manipulate Bitcoin’s price back in 2017. This lead to the belief that the probe by US regulators could trigger the same results.

Overall, Tron’s price seems to have been corrected, and an upward journey is currently expected for Justin Sun’s crypto.

TRON price predictions 2019: TRON is a platform which allows you to build and store the applications. It also allows you to execute the smart contracts based on its blockchain. Moreover, it makes it easier for you to freely publish the content as well as data. This ensures that for the entertainment industry as well as media industry, it is actually a pretty valuable blockchain. This also means that the applications of this particular blockchain are plenty.

With that being said, it is important to look into the cryptocurrency an investment asset as well. Many of the investors are trying to find out whether it is at investing levels currently or not.

The blockchain project, as well as its native currency TRX, has amassed a lot of attention over the past months. Tron provides a platform for developers to create and deploy decentralized applications (Dapps). Ever since Tron launched its Mainnet, it has been a treat to Ethereum. Recently, the founder and CEO of Tron – Justin Sun – said that the network now supports over fifty decentralized apps. Sun made this announcement on Twitter on Thursday, and he said the network is aimed at reaching 80 Dapps in the near term.

Tron Blockchain Achieved 100 Million Transactions in 173 Days

Justin Sun released this statement after the blockchain achieved a major milestone earlier this month. The network achieved 100M transactions over a period of 173 days. This means that an average of 578,034 transactions are being carried on the blockchain of Tron every day.

Tron Sees More Dapp Usage

Back in August, Martin Koppelmann said that a crucial statistic to use in measuring the growth rate of a smart contract protocol is the number of decentralized apps that interact with one another and the usage of decentralized apps. Koppelmann is the founder of Gnosis.ph – a prediction market platform based on the blockchain of Ethereum. According to Koppelmann: “The usage of Dapps is the number we care about. The next thing is to look out for the number of decentralized apps that interact with each other and benefit from each other for being on the same platform. As a side effect, the value of Ethereum (ETH) will then be a function of the demand for the use of apps in this open, reliable, and interrelated environment.” Tron is a smart contract protocol just like Ethereum, and the value of Tron comes from the ecosystem of its decentralized apps and active users.

Tron Dapp Usage Exceeds that of Ethereum

The top three decentralized apps on the Tron network have 2,300 users on average. TRONbet records 2,500 active users and a transaction volume of two million on a daily basis, according to DappRadar. DappRadar is an online platform that provides data on the usage of decentralized apps on major blockchain networks. In comparison, the top three decentralized applications on blockchain of Ethereum has 700 users on average. The three biggest decentralized apps on the network are IDEX, Crypto Heroes, and ForkDelta. However, EOS accounts for the highest number of decentralized app users on its network. TRON (TRX) Price Today – TRX / USD

EOS is the world’s second most valuable smart contract protocol after Ethereum. The top three Dapps on the network have almost 5,000 users on average; this is more than the Dapp users of Ethereum and Tron combined. The top three Dapps on EOS are EOS Knights, PRA CandyBox, and EOSBet. The Dapp usage on the network of Tron has recently exceeded that of Ethereum in terms of daily active users and decentralized apps. Tron and EOS have been focusing more on scalability over the past couple of months. They are focusing more on scalability in their development with the aim of supporting as many decentralized apps as possible in the ecosystem. This is something Ethereum has been lacking, and that is why a lot of developers on the network are now moving to either the blockchain of EOS or Tron.

TRON price predictions 2019:

You can check the cryptocurrency’s current price in the chart at the end of the article. According to investingpr.com, within 5 years, it is expected to trade around over $1. This is the reason why it is a good investment option as well. The main reason why the cryptocurrency is slated to increase by such a significant amount is owing to the increased usage of the platform. As more and more developers start using the platform, it will result in the appreciation of the cryptocurrency as well. This is the reason why the cryptocurrency is slated to increase further. Source: investingpr.com

The decentralized platform will also ensure that it becomes easier for the developers to publish the content. It is one of the very few blockchains which enables easy publishing of the content without any restrictions. This will again provide enormous versatility when it comes to the applications of this platform. As the applications of this platform increase, the usability will increase further. As the usability increases, the prize of the token will increase further. This is the reason why the potential in the platform is enormous. Source: investingpr.com

Thus, if you’re looking to invest in TRON now might be the perfect option to do so as the cryptocurrency is increasing in value consistently. With such large headroom for return in the future, it is worth a look. Source: investingpr.com

TRON [TRX] despite the recent ETH vs TRX controversy expands with 2500 nodes in 31 countries

ambcrypto

The drama related to the recent launch of Tron’s Test Net is still not done. Within a week of the Test Net launch, it has expanded to 31 countries with 2500 nodes despite a bearish market. TRON’s first technical debut – Test net came along with completed nodes, basic network functions, transactions, and customizable modules. This has given fans, followers and skeptics alike a transparent view of Tron’s solid progress.

Jacob Guinto, a TRON enthusiast tweeted:

“Holy, KILLING IT JUSTIN KILLINGGGGG ITTTT! I have personally setup 3 nodes in Czechia – easy process, immediate projection on the map – this is for real guys

great work from Tron foundation and Justin Sun. I think you can setup a node on the moon now.”

There were also people seeking clarification like Kasei Arakaki who asked,

“This is not a doubt or FUD. Asking a genuine question… do we have evidence these nodes are functioning and authentic? I’d love to see some more tangible information regarding the test net and how it is currently running and performing. Maybe someone could provide links for me?”

Tron plans to shed its ERC20 identity and migrate from the Ethereum platform. Once, this goes live, Tron will no longer be an ERC20 token but will become a true token within its own ecosystem.

When TRON’s code first arrived on the scene, TRON was a vibrant, energetic, upstart of a company; a great reflection of its millennial founder.

Justin Sun, the founder said,

“Today, TRON is retaining its fearless energy but adds a much-needed groundedness with the debut of its technology.”

WHAT IS TRON?

CRYPTOCURRENCY’S BUDDING FOUNDER JUSTIN SUN WANTS TO CHANGE THE INTERNET

Source: Newsweek

As the cryptocurrency craze continues, with Bitcoin leading the way, a slew of smaller, cheaper projects are emerging that investors are getting excited about. One is Tron, a coin that its Chinese founder hopes will challenge the world’s major content providers, such as Facebook and YouTube.

According to its website, Tron (TRX) is a blockchain-based platform that seeks to decentralize the internet, or rather content-sharing on the internet, ensuring that artists, creatives, musicians, authoring can release their content without having to use a middle company, be it Amazon, YouTube, Apple, or Facebook.

The digital currency was created by 26-year-old Justin Sun, a self-proclaimed protegé of Alibaba chief executive and billionaire Jack Ma. He has amassed 350,000 Twitter followers, promoting the coin to both its loyal followers and investors, as well as to the wider cryptocurrency community. Forbes listed him in its 30 under 30 for Asia in 2015 and he previously worked for another fledgling cryptocurrency, Ripple (XRP).

The former University of Pennsylvania student is one of the most vocal crypto-founders on the platform, from hosting a one-hour livestream about the coin to announcing partnerships to announcements of a new San Francisco office to promoting a vote for the coin to be accepted by new digital exchanges. He has even engaged in a back-and-forth with the famous founder of Litecoin, one of the top four cryptocurrencies, Charlie Lee, on Twitter.

THE TRON FOUNDATION

The currency to be used on the platform is known as “Tronix.” According to Sun, the cryptocurrency is already set to have a user base of at least 10 million, with Sun announcing that the Tron network will be implemented for his own Chinese social networking app Peiwo.

The coin has so far struck partnerships with a series of major companies, including Chinese video hardware and software provider Baofeng (which Sun dubbed the “netflix of China”), oBike, the largest bike-sharing company in Singapore, which will release “oCoins” on the Tron platform, with riders accumulating coins the more they ride. It also boasts investors such as Wei Dai, the founder of bike sharing company ofo, and a team of developers from Alibaba and Microsoft.

Sun has floated that it has a partnership in the works with a space exploration company, and rumors abound online about a partnership with Alibaba, although these remain unfounded.

It is mostly bought with Bitcoin or Ethereum, the number one and two cryptocurrencies, on the Tokyo-based exchange Binance, and at the time of writing had a market cap of almost $6 billion, despite its low price. The coin began life in September, trading at just a tenth of a penny.

That country is a major market for digital coins, and the country has signaled that it will not ban cryptocurrencies, but more stringently regulate them to stop market manipulation and fraud.

Cryptocurrency critics and advocates of Tron are divided on the potential of the project. Hype, potential, fears and doubt all shape the market price of a cryptocurrency, as does the market supply, and Tron is no different.

Detractors of Tron say that the coin has a circulation of 65 billion coins, too much for it to have any significant monetary value. By contrast, Ripple has a circulation of 38 billion. They also say that Tron is just an idea that is yet to be implemented, so no one can truly tell if it will be a success.

Tron Whitepaper